Buy Now, Pay Later (BNPL) apps have revolutionized the way people shop and pay for goods and services. These apps offer a convenient alternative to traditional payment methods by allowing users to split their purchases into smaller, manageable installments. Whether it’s buying a new gadget or treating yourself to a fancy dinner, BNPL apps make it easy to spread out the cost over time, without the burden of paying everything upfront. With straightforward interfaces and minimal requirements, these apps have become increasingly popular among consumers looking for flexibility and convenience in their spending habits.

One of the key attractions of BNPL apps is their interest-free financing option, which sets them apart from traditional credit cards and loans. By eliminating interest charges, these apps provide users with a more affordable way to make purchases without accumulating debt. This feature not only appeals to budget-conscious consumers but also encourages responsible spending habits. As BNPL continues to gain momentum in the financial technology sector, it’s clear that these apps are reshaping the retail landscape and empowering individuals to shop smarter and more efficiently.

Affirm

The Affirm Card offers a unique advantage by seamlessly integrating with your bank account, providing you with expanded choices at the point of purchase. This feature ensures flexibility and convenience, allowing users to access more payment options directly from their bank account, making transactions smoother and more tailored to individual preferences.

Request Payment Plans in Advance

Planning ahead for your purchases becomes effortless with Affirm. Through the app, users can proactively request payment plans before proceeding to checkout. This proactive approach empowers consumers to manage their finances more effectively, enabling them to budget and schedule payments according to their needs and preferences.

Shop Anywhere with Linked Bank Account

Affirm simplifies shopping on the go by enabling users to link their bank account to pay with the Affirm Card at nearly any location. Whether online or in-store, users can enjoy the convenience and security of using their bank account for transactions, making shopping more accessible and hassle-free. Additionally, the app facilitates post-purchase flexibility by allowing users to request payment plans for eligible purchases after completing transactions.

Affirm: A Smarter Alternative to Credit Cards

Affirm’s mission stems from addressing the shortcomings of traditional credit cards, which often lead to substantial debt burdens for consumers. By offering a transparent and flexible payment solution, Affirm ensures that users never owe more than what they agree to upfront. This commitment to transparency and affordability sets Affirm apart, providing consumers with a smarter way to manage their finances and make purchases over time.

Buy Now, Pay Later without Fees

One of Affirm’s standout features is its fee-free approach to buy now, pay later transactions. With Affirm, users can enjoy the convenience of spreading payments over time without incurring additional fees, allowing them to stay within their budget while still acquiring the things they love. This fee-free model reinforces Affirm’s commitment to providing consumers with a fair and accessible payment solution that aligns with their financial goals and preferences.

Read More: The Best Xbox Series X Headsets for 2023

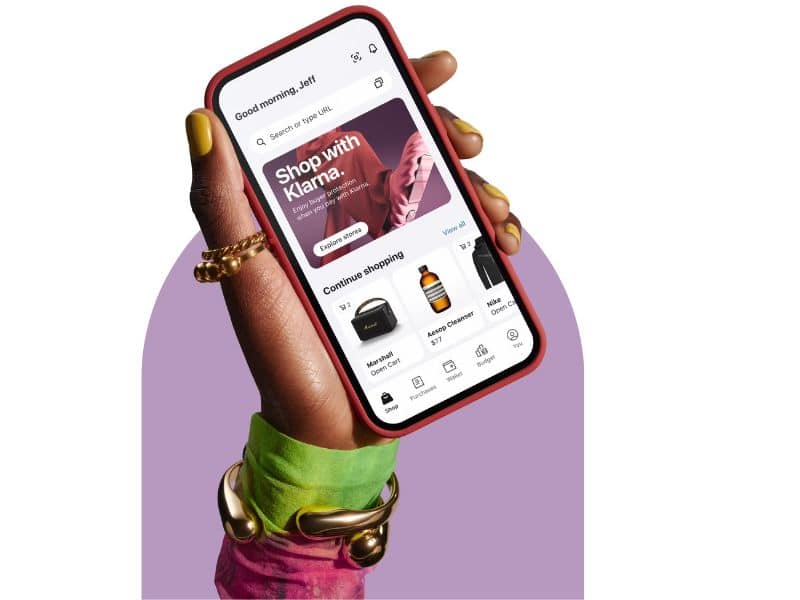

Klarna

Klarna stands out as one of the the best BNPL apps due to its unparalleled flexibility in payment options. With Klarna, users have the freedom to choose exactly how much they want to pay and when, every time they shop. This flexibility empowers customers to manage their budgets more effectively, allowing them to tailor their payment schedules to suit their financial needs and preferences.

Lightning-Fast Checkout

Another key advantage of Klarna is its lightning-fast checkout process. By integrating seamlessly with over 20,000 partner stores, Klarna enables users to breeze through checkout with ease. This streamlined experience saves valuable time and reduces friction in the shopping journey, ensuring a hassle-free transaction process for customers.

Secure Shopping

Klarna prioritizes the security of its users’ transactions, providing peace of mind with every purchase. Users can trust Klarna’s secure payment system, knowing that their financial information is protected. This commitment to security enhances the overall shopping experience, fostering trust and confidence among Klarna’s 150 million customers worldwide.

Hassle-Free Returns

Klarna simplifies the returns process with its hassle-free system. If a purchase isn’t quite right, users can report returns with a tap and only pay for what they decide to keep. This convenience ensures that customers can shop with confidence, knowing that they have the flexibility to return items easily if needed.

Paypal

PayPal has become synonymous with secure online transactions and effortless money transfers since its inception in 1998. Founded by Elon Musk and Peter Thiel, and later acquired by eBay in 2002, PayPal quickly emerged as a leading digital payment platform, revolutionizing the way people conduct financial transactions online. With its user-friendly interface, robust security measures, and widespread acceptance across millions of merchants worldwide, PayPal has cemented its position as a trusted and convenient tool for individuals, businesses, and freelancers alike. In this short introduction, we’ll delve into the key features and functionalities that have made PayPal an indispensable part of the digital economy.

Widely Available

PayPal’s BNPL service is widely available, allowing users to shop at their favorite brands and enjoy the convenience of paying later. This accessibility ensures that consumers can take advantage of the flexibility offered by PayPal across a broad range of merchants, enhancing their shopping experience without constraints.

Quick Decision and Easy on Your Credit Score

With PayPal’s Pay in 4 option, users can make purchases without worrying about impacting their credit score. The quick decision process ensures a seamless shopping experience, providing reassurance to users that their creditworthiness won’t be affected. This feature empowers individuals to make purchases confidently, knowing that they can spread payments without any negative implications on their financial standing.

Read More: Best Cable Modems in 2024

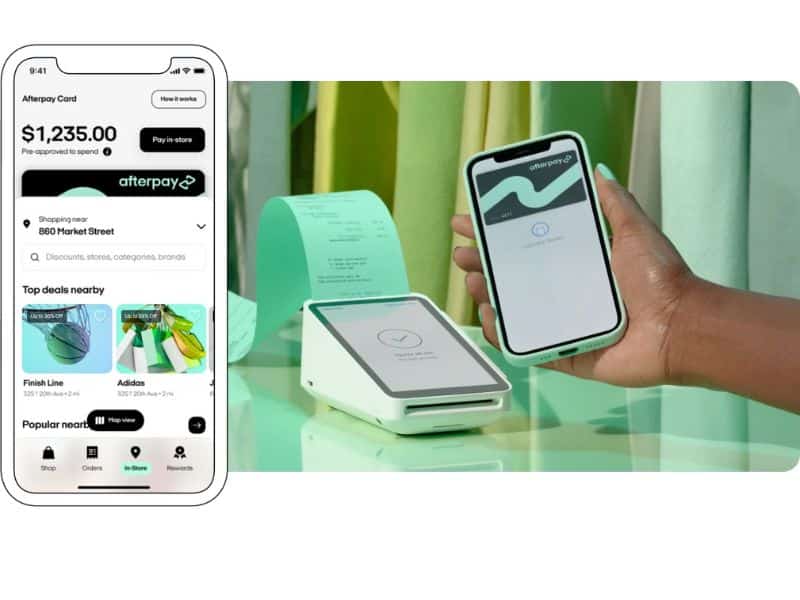

Afterpay

Afterpay is revolutionizing the way we shop by offering a simple yet powerful solution for managing payments. With Afterpay, you can enjoy the convenience of splitting your purchases into four interest-free installments, allowing you to budget your spending effectively. Whether you’re shopping online or in-store, Afterpay provides access to thousands of brands and millions of products, making it easier than ever to get what you need without breaking the bank. Say goodbye to hidden fees and late payment penalties – Afterpay is here to help you shop smarter and achieve financial wellness.

Convenient Shopping Experience

Afterpay offers a seamless shopping experience with access to thousands of brands and millions of products, both online and in-store. Whether you’re browsing for clothing, gadgets, or household items, Afterpay’s extensive network of retailers ensures that you can find everything you need in one place.

Flexible Payment Options

With Afterpay, you can pay for your purchases in four interest-free installments over six weeks, providing you with the flexibility to manage your budget effectively. By making the first payment upfront and spreading the remaining cost over time, Afterpay empowers you to make larger purchases without the burden of paying everything upfront. Additionally, Afterpay incentivizes timely payments by waiving fees and providing reminders to help you stay on track. This commitment to financial wellness ensures that you can enjoy the benefits of BNPL while maintaining control over your spending habits.

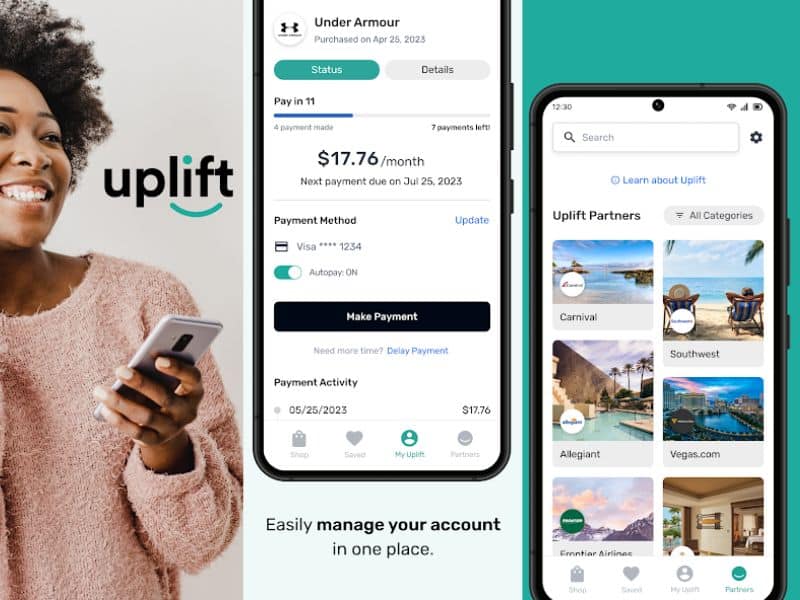

Uplift

Uplift offers a seamless and hassle-free experience for buyers, providing a sense of satisfaction and confidence in their purchases. With Uplift, there are no surprise payments or hidden fees, allowing users to buy now and pay later without any unexpected financial burdens. The straightforward payment process ensures transparency and peace of mind, making shopping a joyous experience.

Flexible Payment Options

Uplift allows users to spread the cost of their purchases over fixed monthly payments, providing flexibility and convenience. This feature enables individuals to make thoughtful purchases without straining their budget, as they can pay in bite-sized installments over time. Additionally, Uplift does not charge any fees, including late fees or pre-payment penalties, further enhancing its appeal to budget-conscious consumers.

Easy Application and Quick Decision

Uplift offers an easy application process and provides quick decisions, allowing users to access their payment plans swiftly. By simplifying the process and eliminating unnecessary complications, Uplift ensures a smooth and efficient experience for its users. With Uplift, buyers can enjoy the convenience of a smarter way to pay, enhancing their overall shopping experience.

Conclusion

In conclusion, the landscape of Buy Now, Pay Later (BNPL) services continues to evolve, offering consumers innovative solutions for managing their finances and making purchases. The features and benefits provided by BNPL apps, such as transparent payment plans, flexibility in payment options, and ease of use, have transformed the way people shop and pay for goods and services. With no surprise payments, fair and straightforward monthly installments, and a user-friendly application process, BNPL apps have become a popular choice for individuals seeking convenience and peace of mind in their spending habits. As technology advances and consumer preferences evolve, BNPL services are likely to remain a key player in the financial technology sector, empowering users to make smarter and more informed purchasing decisions.