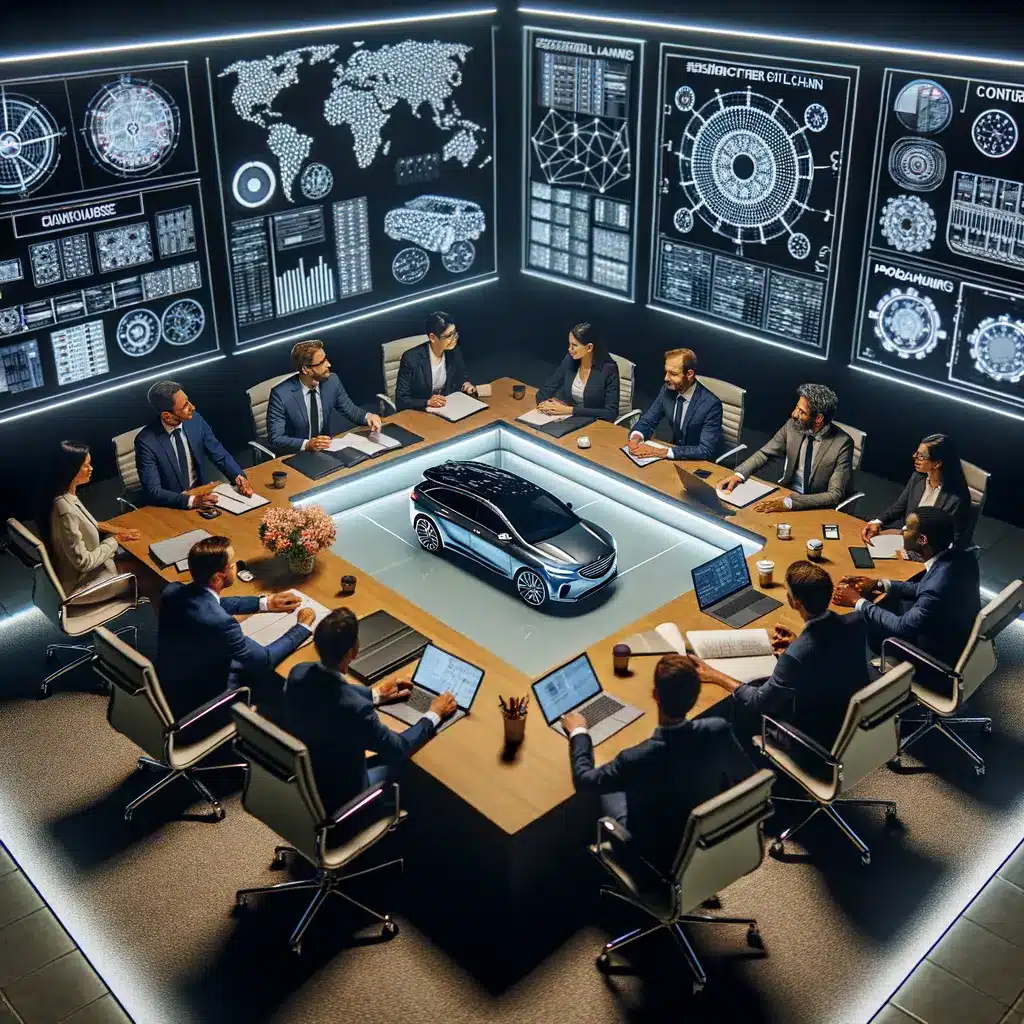

The New Automotive Paradigm: Why Software Defined Vehicles Matter

Walk into any R&D center in Detroit, Shanghai or Munich in 2025 and the buzzphrase you’ll hear is software defined vehicles. The term describes cars whose value is governed more by code than by combustion, where new features arrive like smartphone apps and where hardware is intentionally generic so that software can work its magic. While the phrase software defined vehicles first gained traction a decade ago, only now has it crossed from conference slide decks into showrooms. Market analysts at Deloitte peg the global software defined vehicles market at $213.5 billion last year and expect it to balloon to $1.24 trillion by 2030, a compound annual growth rate that eclipses even the early days of the smartphone.

This growth is not happening in a vacuum. It coincides with another megatrend: rebuilding the semiconductor supply chain after a bruising shortage that cost automakers more than $210 billion in lost revenue. A single missing $1 micro-controller halted $50,000 pickup trucks—proof that mobility is only as strong as the silicon underneath. The convergence of these two forces forms what many experts call the new automotive paradigm: deliver functionality through continuous software while guaranteeing hardware availability through a resilient semiconductor supply chain. Over the next six sections we’ll explore how over-the-air updates, automotive AI personalization, zonal architecture, and strategic chip sourcing are reshaping every stakeholder, from OEMs to local dealerships.

Over-the-Air Updates: The Business Engine Inside Every Car

Because software defined vehicles rely on modular code, an operating-system patch is no longer a mechanical afterthought; it is core to the business model. Research firm IDTechEx values the automotive over-the-air updates market at $4.35 billion and sees 20 % yearly growth. Why the acceleration? Updating millions of lines of code remotely eliminates physical recalls, saving roughly $300 per vehicle while giving customers fresh functionality overnight.

Tesla popularised the tactic by fixing a 1.68 million-vehicle recall in China without a single service-bay appointment. BMW, Mercedes-Benz and Geely now follow suit, shipping new user-interface skins, range-enhancing battery maps and even subscription-based seat massagers by Wi-Fi and cellular. In a world of software defined vehicles, a car’s first day on the road is merely version 1.0.

Importantly, the economics extend far beyond customer delight. Each successful push strengthens brand loyalty and yields granular telemetry that feeds the semiconductor supply chain. By analysing update success rates at the ECU level, OEMs can forecast demand for specific micro-controllers months in advance—an invaluable input when wafer capacity is scarce. For suppliers, that transparency reduces inventory guesswork; for drivers, it means fewer “chip-shortage” headlines. If you’re new to the technology, see our post on secure over-the-air protocols for a deeper dive into encryption and homologation requirements.

AI Personalization and Zonal Architecture: Reimagining the Cabin

Step inside a modern cockpit and you’ll see the other edge of the software revolution: automotive AI personalization layered on top of zonal architecture. In software defined vehicles, cabin sensors—cameras, microphones, seat-pressure mats—feed real-time data to neural-network models that tailor everything from ambient lighting to recommended rest stops. BMW’s Emotional Intelligence system can even detect a driver’s yawn and politely offer to activate Level-2 automation.

This magic relies on massive compute. Legacy cars used more than 100 discrete electronic control units scattered throughout the chassis. Zonal architecture collapses those into a handful of high-performance domain controllers connected by Ethernet. The result is 50 % less wiring, a lighter vehicle, and a single gateway for cybersecurity patches. Continental reports its zone control units cut harness weight by up to 18 kg and shave $500 in materials.

For developers, the new architecture feels familiar: write once, deploy everywhere. A single over-the-air update can refresh the infotainment stack, power-train logic and advanced driver-assistance features in one shot. The tight coupling between zonal hardware and AI models gives software defined vehicles an experiential edge that legacy competitors cannot match. Curious about the underlying networks? Consult our explainer on automotive Ethernet versus CAN-FD for more context.

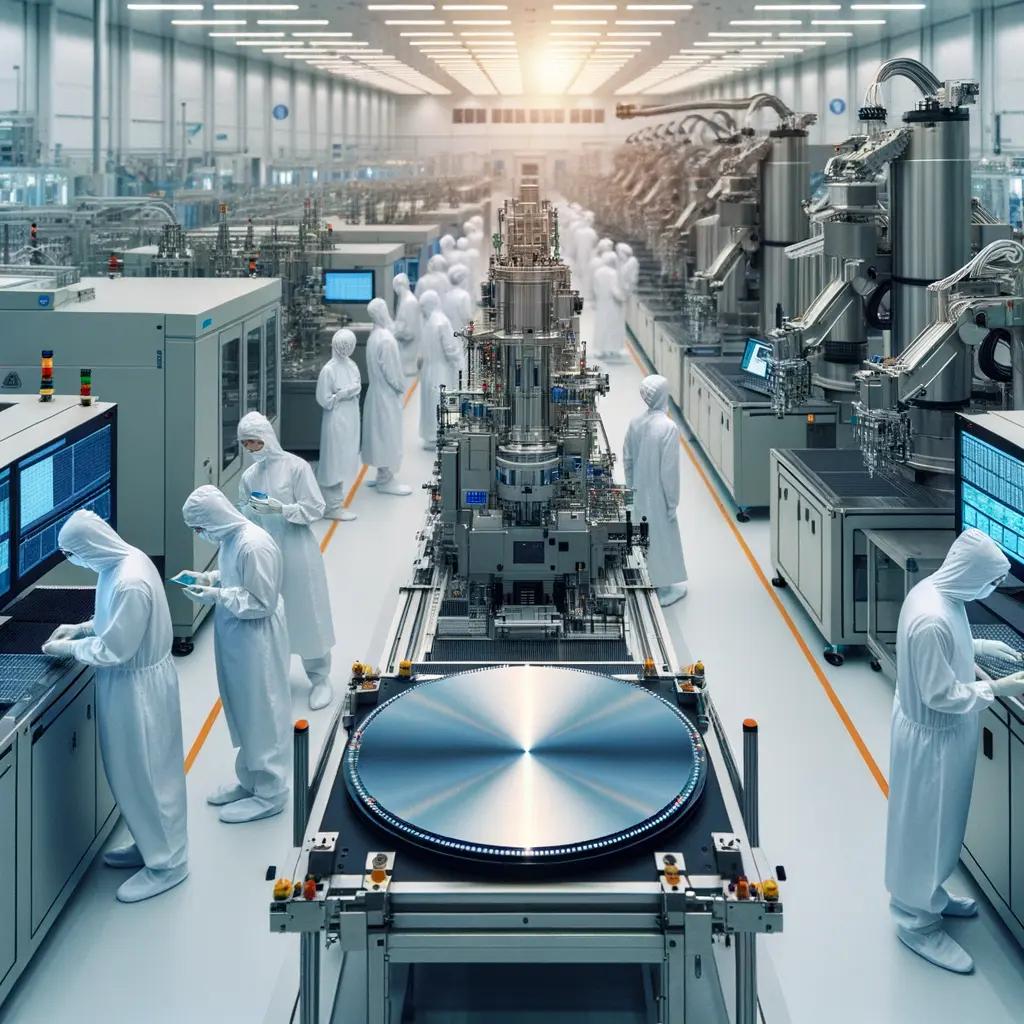

Building a Resilient Semiconductor Supply Chain for SDVs

Of course, no amount of elegant code matters if the chips are missing. The 2020-2024 shortage revealed how fragile a just-in-time semiconductor supply chain can be. Advanced software defined vehicles consume roughly 40 % more silicon than legacy models, making resilience not optional but existential. Automakers now pursue three complementary strategies.

First is vertical integration. Nearly half of global OEMs design proprietary system-on-chips; Tesla’s fourth-generation FSD processor doubles inference speed without increasing power draw. Second is geographic diversification. Enabled by the CHIPS Act, North American fabs from Intel, TSMC and Samsung will bring the region’s share of advanced logic to 28 % by 2032, while near-shoring in Mexico further shortens lead times. Third is AI-driven planning. Ford’s machine-learning models flag supply disruptions sixty days ahead with 70 % accuracy; Volkswagen’s digital twin maps 9,000 suppliers in real time.

Together these initiatives create a feedback loop between the semiconductor supply chain and software defined vehicles. When an OEM can predict wafer shortages early, engineers can remove at-risk components from upcoming over-the-air updates or swap them for pin-compatible alternatives. Expect partnerships between cloud providers and tier-ones to accelerate this trend. (The embedded YouTube discussion will appear here for additional context.)

Dealership Disruption: Service 2.0 in the SDV Era

Dealerships sit at the intersection of customer expectation and technological change, and the rise of software defined vehicles is rewriting their profit formula. Standard software and recall work—once a dependable revenue stream—is increasingly handled remotely. According to NADA data, dealer pre-tax profit fell 24.4 % last year, with software service revenue sliding from $1.8 billion to $1.4 billion as over-the-air updates accounted for 78 % of fixes.

Forward-thinking stores are pivoting. Specialised EV maintenance, cybersecurity audits and personalised connectivity bundles are services that cannot be delivered solely by code. Some groups even sell optional features—heated-seat subscriptions, performance modes—through dealership-branded apps, sharing revenue with the OEM. Their new role resembles a “technology consultant” more than a traditional repair shop.

Training is key. Staff must explain zonal architecture benefits, guide customers through AI personalization settings, and reassure them about data privacy. Implementing in-showroom demo stations that mirror the infotainment environment of leading software defined vehicles helps reduce delivery anxiety. For more strategies, explore our case study on digital retailing best practices.

Road Ahead: Aligning Software Defined Vehicles with Supply Resilience

The road ahead is undeniably digital, yet it is also grounded in atoms: copper wires, silicon wafers and lithium cells. Success will belong to brands that treat software defined vehicles and semiconductor resilience as two halves of the same strategy. That means designing vehicles with updateable modules, securing multi-regional chip capacity, and capturing data to refine both.

Expect regulatory oversight to grow. UNECE R156 already mandates cybersecurity management for over-the-air updates; similar rules for supply-chain transparency are coming. Companies that build compliance workflows into their DevOps pipelines today will iterate faster tomorrow.

For suppliers, opportunity abounds. Tier-ones that bundle zonal controllers with lifetime update services can lock in long-term revenue. Chipmakers offering functional-safety certified reference designs will win sockets in the next generation of software defined vehicles. Dealerships, too, can thrive by embracing an advisory role and monetising digital add-ons.

In short, the automotive industry is moving from horsepower to code-power, from single-source wafer risk to distributed resilience. Organisations that align product roadmaps, procurement and customer experience around software defined vehicles will not just survive—they will lead the next decade of mobility innovation.