Why 2025 Matters: Setting the Stage for Bitcoin’s Next Move

Bitcoin price prediction 2025 conversations have shifted from speculative hype to data-driven analysis. At the start of the year, BTC reclaimed five-digit territory after a brief pullback, and the subsequent BTC price surge toward the $112,000–$113,000 range has investors asking the same question: how high can it realistically go? Understanding the drivers now is critical because they will frame the risk-to-reward ratio for the remainder of the cycle.

Macroeconomic policy, institutional behaviour and on-chain fundamentals have converged in a way we have not seen since the 2020–2021 bull run. The U.S. Federal Reserve signalled potential rate cuts, weakening the dollar and prompting capital rotation into scarce assets. At the same time, record ETF inflows are turning Bitcoin into a mainstream portfolio allocation.

For newcomers, BTC’s supply dynamics—strict 21-million cap, the most recent halving and hash rate climbing to all-time highs—differentiate it from any fiat alternative. Seasoned traders, meanwhile, are scanning moving averages, open interest and funding rates for confirmation of further upside. In this introductory section we break down why the current environment could be the perfect storm, laying the groundwork for deeper analysis of each specific catalyst in the sections below. Internal resources you might revisit include our guides on on-chain metrics and our Ethereum price projection article for additional context.

Macroeconomic Tailwinds: Rate Cuts, Inflation & Capital Rotation

Few variables impact any Bitcoin forecast more than global monetary policy. With U.S. inflation cooling yet remaining above the Federal Reserve’s 2 % target, policymakers have hinted at as many as three quarter-point rate cuts before year-end. Historically, easing cycles reduce yields on bonds and savings accounts, nudging capital toward higher-beta assets. Bitcoin, often dubbed digital gold, becomes an obvious beneficiary because of its deflationary supply.

Institutional desks have already started rebalancing. Last quarter, several multi-asset funds trimmed long-duration treasuries and added Bitcoin ETFs, citing asymmetric upside compared with equities. Meanwhile, de-dollarisation rhetoric among BRICS nations has revived interest in store-of-value assets independent of central-bank control. BTC’s decentralised architecture provides a hedge against currency debasement in emerging markets wrestling with double-digit CPI prints.

For retail traders, the macro backdrop translates into concrete trading signals. Watch the U.S. Dollar Index (DXY): when it falls, Bitcoin usually pops. Monitor real yields; a dip below 1 % historically coincides with a BTC price surge. Macro analysts also recommend tracking the spread between two- and ten-year treasuries. A steepening curve after a prolonged inversion often marks liquidity returning to risk assets. For more macro literacy, check our explainer on the Fed’s balance-sheet mechanics.

Wall Street Embraces BTC: How Institutional Adoption Is Changing the Game

Nothing validates the institutional adoption of Bitcoin more than the avalanche of spot Bitcoin ETFs approved in January 2024. BlackRock, Fidelity and Vanguard combined have attracted more than $48 billion in net inflows—outpacing even gold-backed funds over the same period. By offering a compliant, liquid and custody-handled vehicle, Bitcoin ETFs remove the technical friction that once deterred pension funds and corporate treasuries.

The implications are profound. First, ETF demand tightens supply because issuers must acquire actual BTC to back shares, reducing float on exchanges. Second, it standardises valuation models; analysts can now use traditional metrics—assets under management, flows and basis trades—to gauge sentiment. Third, corporate CFOs finally have a GAAP-friendly path to add Bitcoin to balance sheets, a trend we saw last cycle with MicroStrategy but now at a potentially much larger scale.

Beyond ETFs, prime brokers are rolling out collateralised lending, while custodians like BBVA and State Street offer cold-storage solutions insured by Lloyd’s of London. These developments dismantle the “Wild West” narrative, fostering regulatory comfort. Expect continued mergers between crypto-native and TradFi platforms, expanding Bitcoin’s liquidity profile. (The full YouTube deep dive is embedded below for those who prefer video analysis.)

Tech & Ecosystem Developments: Sustainability, Layer-2s and Beyond

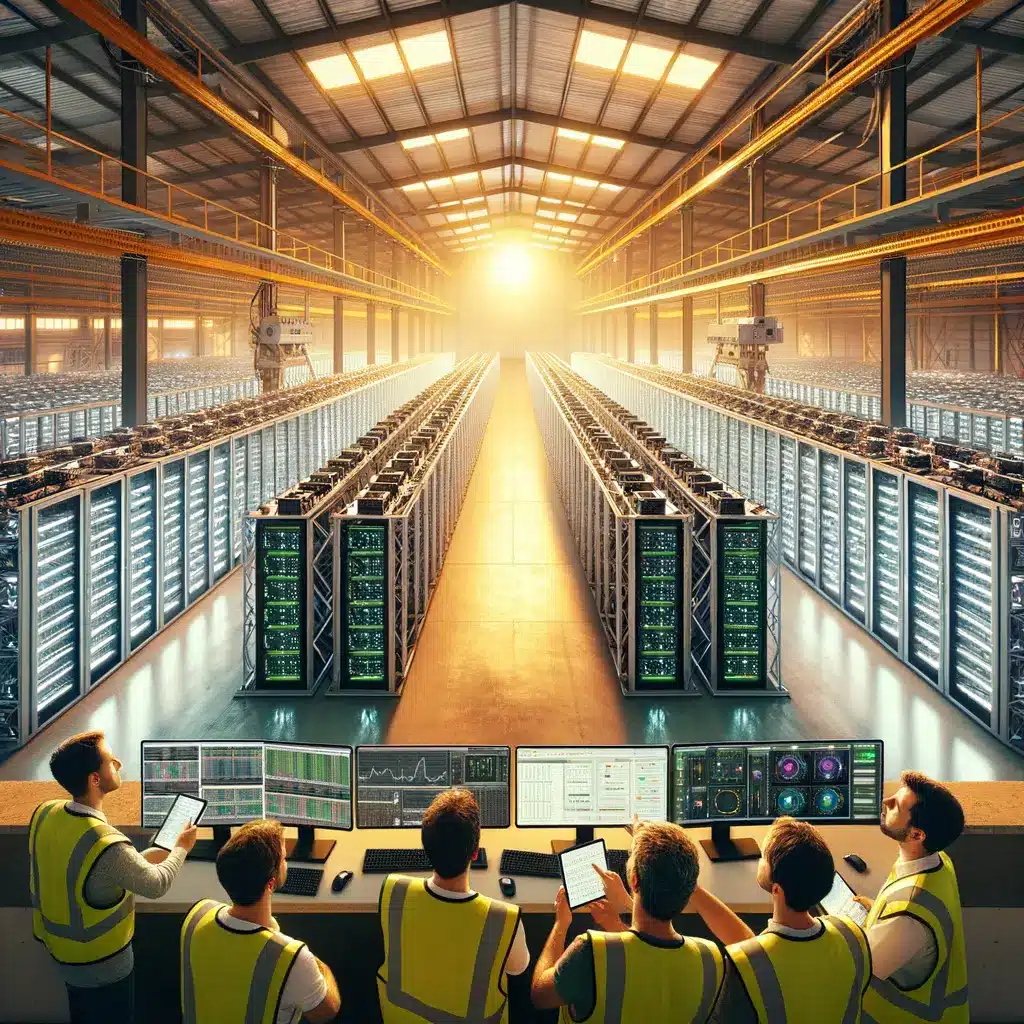

While price action steals headlines, technological innovation continues to reinforce the long-term Bitcoin forecast. The mining sector, once criticised for energy use, is rapidly greening. Publicly listed miners in Texas and Kazakhstan report that more than 60 % of their power now originates from wind, solar or flare-gas recapture. These improvements not only reduce carbon footprints but also stabilise mining costs, protecting network security even in bear phases.

Meanwhile, layer-2 solutions such as the Lightning Network have expanded payment throughput, with capacity surpassing 5,900 BTC this quarter. Faster, cheaper transactions bolster Bitcoin’s utility for everyday payments in El Salvador and digital-nomad hubs like Madeira. On the custody front, multisig wallets paired with hardware devices from Ledger and Trezor make self-sovereignty safer for both retail and institutions.

Interoperability is another theme. Sidechains like Rootstock enable smart-contract functionality, letting DeFi developers tap Bitcoin’s liquidity without sacrificing security. As a result, total value locked (TVL) in Bitcoin-adjacent DeFi protocols has climbed to $1.2 billion, a 300 % year-over-year increase. Regulatory sandboxes in Singapore and Switzerland are accelerating these experiments, highlighting how technological progress underpins every credible Bitcoin price prediction 2025 scenario.

Technical Analysis: Key Levels, Indicators & Probable Price Targets

Chartists eye three pivotal support zones: $110,000, $100,000 and the 200-day moving average near $92,500. Holding the first confirms bullish structure; losing the second could trigger a broader shake-out. On-chain metrics—such as realised price ($36,100) and long-term holder cost basis ($53,800)—show that current market participants remain in solid profit, historically reducing sell-side pressure.

Volume confirms trend. Daily exchange volume averages $48 billion, 22 % above the 90-day mean, indicating conviction behind the latest BTC price surge. The relative strength index (RSI) on the weekly chart sits at 68, not yet overbought, leaving room for continuation. A breakout above $120,000 opens the door to $135,000, the 1.618 Fibonacci extension from the November 2022 bottom. Conversely, a rejection could send price back to the $105,000 pivot where significant ETF inflows first arrived.

Traders should monitor moving-average convergence divergence (MACD) crossovers on the 12- and 26-period timeframe, plus funding-rate spikes above 0.1 % that often precede pullbacks. Remember, leverage cuts both ways. Always combine TA with macro cues discussed earlier. For a deeper dive into reading candlestick formations, revisit our tutorial on reversal patterns.

Conclusion: Navigating Opportunities & Risks in Bitcoin’s 2025 Landscape

Putting it all together, Bitcoin price prediction 2025 is no longer a speculative dart throw. Macro liquidity, institutional adoption of Bitcoin via ETFs, sustainability milestones and bullish technicals form a coherent narrative. Still, investors must weigh potential headwinds: unexpectedly hawkish central banks, restrictive legislation or a black-swan exchange failure could derail momentum. Mitigating those risks means diversifying position sizes, securing holdings with reputable custodians and staying informed.

For long-term portfolios, Bitcoin remains an effective hedge against inflation and policy uncertainty. Dollar-cost averaging has historically outperformed market-timing strategies, and holding periods beyond four years have yet to produce a negative return. Active traders, on the other hand, can exploit volatility by combining the support-resistance map outlined earlier with macro event calendars (think FOMC meetings or ETF flow reports).

Ultimately, Bitcoin’s resilience stems from its decentralised design and the network effect of millions of users, miners and developers worldwide. Whether you’re allocating 1 % or 10 % of your capital, treat due diligence as a continuous process. Bookmark our upcoming pieces on stablecoin regulation and Solana’s scaling roadmap for additional context. Stay disciplined, stay curious and let sound research—not fear or euphoria—guide your decisions in the year ahead.