Why the Bitcoin Crash Really Matters: Beyond the Price Chart

Every headline shouts about the Bitcoin crash, and every social feed is flooded with red candlesticks. Yet the real story is not the sudden drop on your screen—it is the systemic stress those candles reveal. Price is only the surface ripple; below it sits the vast plumbing of modern finance. When the Bitcoin crash dominated search trends this week, trading apps, brokers and even bank portals flickered under record traffic. We witnessed in miniature what 2020’s GameStop frenzy and 2023’s Silicon Valley Bank failure had already shown: access to your own money can be switched off without warning. Bitcoin’s ethos of self-custody promises freedom from middlemen, but most investors still funnel trades through centralized exchanges and Bitcoin ETF products. Each extra link in that chain introduces a new point of failure. If you focus solely on the price chart, you miss the escalating issues of access, settlement and counterparty risk that the current Bitcoin crash has laid bare. Throughout this article we will unpack those hidden threats, show why they matter far beyond crypto, and outline practical safeguards you can implement today. For deeper background, you may also want to read our breakdown of fractional-reserve banking and our primer on cold-storage wallets—both are directly relevant to understanding what is unfolding now.

Liquidity Crisis: When Markets Seize Up and Sellers Outnumber Buyers

A liquidity crisis occurs when everyone wants cash and almost no one wants the asset that is falling. During this Bitcoin crash, billions of dollars of leveraged positions were forcibly liquidated because exchanges could not find bids high enough to meet margin calls. The popular “basis trade,” in which hedge funds bought spot Bitcoin via ETFs and shorted futures for an easy spread, had quietly propped up demand for months. Once that trade turned unprofitable, funds unwound en masse, yanking liquidity from the order book in seconds. The result was a cascade of automatic sell orders feeding into an ever-thinner pool of buyers—a textbook liquidity crisis.

The same pattern was visible in 2008 with mortgage-backed securities and again when Silicon Valley Bank depositors triggered a digital bank run. In each case, the initial decline was not the core problem; what mattered was the evaporation of bids and the speed at which money stopped moving. Watching depth charts shrink from thousands of BTC to mere dozens is a chilling reminder that a market is only liquid until it isn’t. Investors who survived past crashes keep emergency cash, diversify venues and pre-stage stablecoin redemptions to ride out liquidity crunches. You can explore additional tactics in our guide to managing exchange risk during volatile trading sessions.

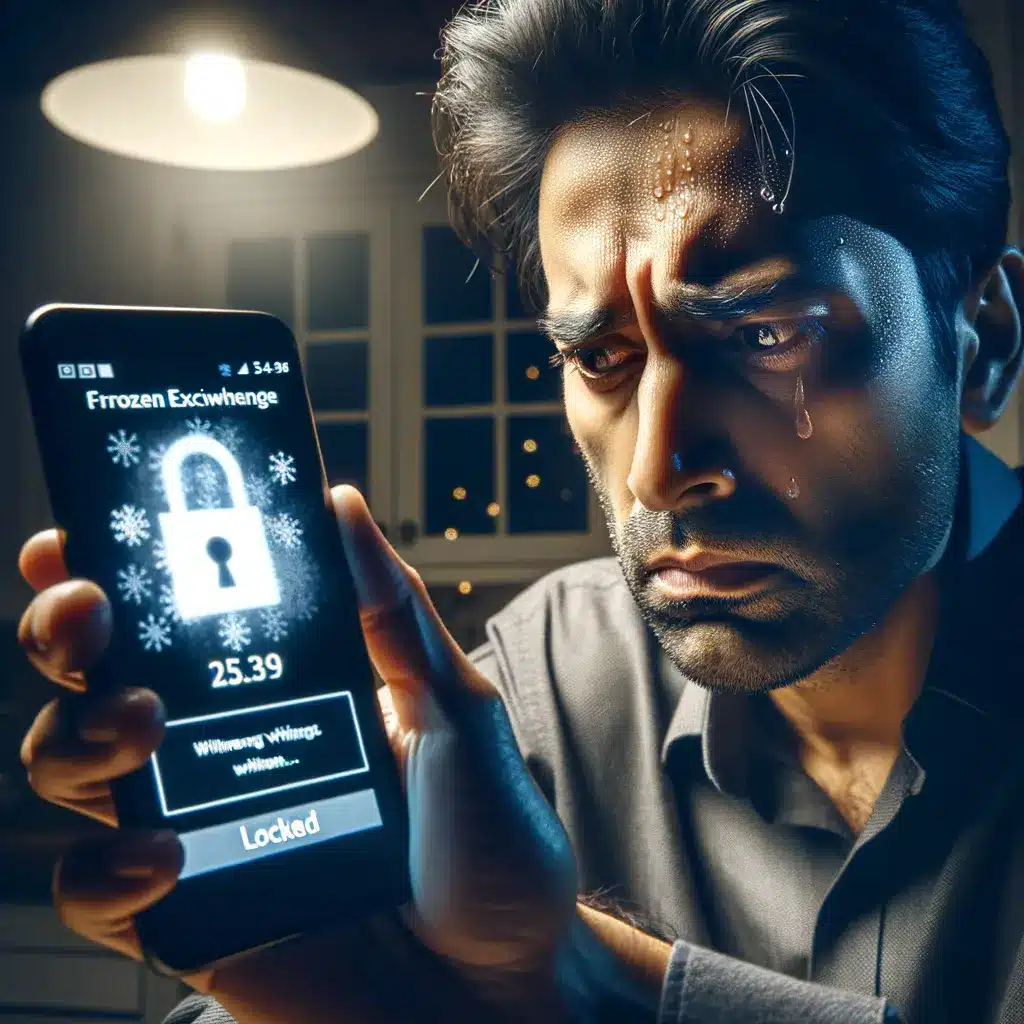

Access Failure: When Exchanges and Banks Lock the Exit Doors

Access is the pillar most investors take for granted—until it fails. At the peak of the current Bitcoin crash, several major exchanges slowed withdrawals and some brokerage apps timed out entirely. These glitches were not grand conspiracies; they were simple math. Server capacity built for average load buckled under a stampede of panic sellers, mirroring Robinhood’s 2021 decision to disable the GameStop buy button. If you could not log in, the theoretical price of your holdings became irrelevant—you had zero ability to act.

Traditional finance offers no immunity. When Silicon Valley Bank toppled, its website froze and wiring funds out became impossible for hours. USDC’s momentary de-peg to 87 cents was a direct result: reserves stuck in a shuttered bank meant redemption confidence collapsed. In practice, money that cannot be moved might as well not exist. Strategies to mitigate access failure include spreading positions across multiple exchanges, pre-verifying higher withdrawal limits, and maintaining a hardware wallet with a portion of funds offline. Long-term readers may recall our tutorial on setting up multisig storage—reviewing that process now could save hours of stress during the next Bitcoin crash.

Settlement Risk: The Invisible Delay Hiding Inside Every Trade

Clicking “sell” feels instant, but behind the interface is a dance of clearing and settlement that can take hours—or a full business day in stock markets. That delay is harmless in calm periods yet lethal during a crypto market crash. Clearing houses demand extra collateral from brokers when volatility spikes, and if a broker cannot post it, trading halts. We saw this publicly during the GameStop saga and quietly during multiple flash crashes in crypto derivatives. Bitcoin’s blockchain does provide near-final settlement once a transaction is confirmed on chain, but the moment you introduce a custodian, an ETF wrapper or a payment processor, traditional settlement risk sneaks back in.

During the recent Bitcoin crash, users reported withdrawal queues lasting four to six hours—an eternity when prices swing double digits in minutes. The lesson is stark: transactions are complete only when the asset is in a wallet you control. Consider pre-funding cold storage before volatility hits, using SegWit or Taproot addresses for faster confirmations, and testing small withdrawals from each platform monthly to verify nothing has silently broken. Our article on how the T+2 stock-settlement cycle works offers further insight into why delayed finality is an under-appreciated danger in every market.

Counterparty Risk: Trust, Insolvency and the FTX Lesson

Counterparty risk is the possibility that the entity on the other side of your trade—or safeguarding your asset—goes bust. Lehman Brothers, AIG, Mt. Gox, Celsius and most recently FTX all illustrate that even regulated or heavily advertised brands can implode overnight. The Bitcoin crash has reignited debate about whether Bitcoin ETFs reduce or merely shift this danger. While an ETF spares you from exchange hacks, it binds your exposure to stock-market hours, custodial rules and clearing-house solvency. You cannot move ETF shares to a hardware wallet on Friday night if headlines break about fraud.

Understanding counterparty layers is therefore crucial. Ask: Who holds the private keys? Which insurer underwrites losses? What jurisdiction governs the custodian? Diversifying across jurisdictions, insisting on proof-of-reserves and keeping a portion of holdings in self-custody all cut the tail risks dramatically. The same logic applies outside of crypto—money-market funds, prime brokers and even stablecoin issuers each carry unique default pathways. To explore practical vetting steps, see our checklist on evaluating custodial platforms before wiring large sums.

Protecting Yourself Before the Next Bitcoin Crash Hits

History shows that another Bitcoin crash—or broader crypto market crash—is inevitable. Preparing now is cheaper than reacting later. Start by mapping your personal exposure: list every exchange, bank and broker that touches your assets. Next, segment funds into three buckets. Bucket 1: day-to-day liquidity kept on multiple exchanges with two-factor authentication and withdrawal whitelists. Bucket 2: medium-term holdings in multisig cold storage spread across geographic locations. Bucket 3: long-term savings in fully offline hardware wallets stored in bank vaults or equivalent secure facilities. Aim to keep at least one month of living expenses in fiat cash so you can wait out temporary access or settlement failures.

Monitor real-time stress signals: widening futures basis spreads, unusual delays in stablecoin redemptions, spikes in Google searches for “withdrawal frozen,” and news of clearing-house collateral hikes. Each is an early warning that liquidity is draining again. Finally, revisit insurance—both traditional and crypto-specific policies—to cover black-swans like exchange hacks or custodial insolvency. Implementing even half of these measures will dramatically improve your odds of staying solvent and calm when the next Bitcoin crash dominates the airwaves. For additional reading, our guides to decentralized self-custody solutions and the history of bond-market liquidity crunches provide valuable context.